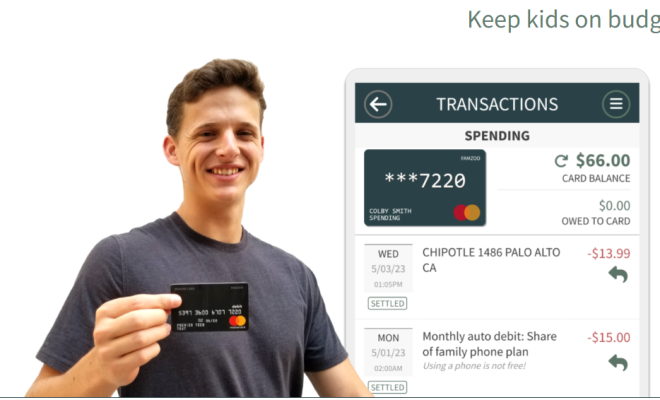

FamZoo Review: Empowering Families with Financial Literacy Through Prepaid Cards

Introduction

In today’s digital age, teaching children about money management is more crucial than ever. FamZoo offers a comprehensive solution to this challenge by providing a family-friendly platform that combines prepaid debit cards with financial education tools. Founded in 2006, FamZoo has been at the forefront of helping families instill good money habits in their children.

Product Overview

FamZoo provides a virtual family banking system that includes prepaid debit cards and a suite of financial education tools accessible via a mobile app or web browser. The platform is designed to help parents teach their children to earn, save, spend, and donate money wisely in a safe, friendly environment.

Key Features:

- Prepaid Debit Cards: Each family member can have their own prepaid debit card, which can be used anywhere Mastercard is accepted. These cards are FDIC insured and come with features like spending limits and transaction alerts.

- IOU Accounts: For younger children not ready for a debit card, FamZoo offers IOU accounts to track money held elsewhere by parents.

- Automated Allowances and Chores: Parents can set up automated allowances, chore charts, and even penalties for missed tasks, teaching children the value of earning money.

- Savings Goals and Interest: FamZoo encourages saving by allowing parents to set up savings goals and pay interest on saved amounts, promoting long-term financial habits.

- Family Loans and Billing: The platform includes features for tracking family loans and shared expenses, helping children understand the concept of borrowing and shared financial responsibilities.

Pricing

FamZoo offers several subscription plans to suit different family needs:

- Monthly Plan: $5.99 per month

- 6-Month Prepay: $25.99 (averages $4.33/month)

- 12-Month Prepay: $39.99 (averages $3.33/month)

- 24-Month Prepay: $59.99 (averages $2.50/month)

These plans cover the entire family, regardless of the number of children. Additional fees may apply for card replacements or expedited shipping.

User Experience

Users consistently praise FamZoo for its user-friendly interface and comprehensive features. The mobile app is available on both iOS and Android platforms, providing easy access to account management on the go.

Parents appreciate the ability to customize allowances, set up chore charts, and track spending in real-time. Children benefit from hands-on experience with money management, learning valuable lessons about budgeting, saving, and financial responsibility.

Security

FamZoo prioritizes security by ensuring that funds are FDIC insured and protected by Mastercard’s Zero Liability policy for unauthorized purchases. The platform does not store private bank account or debit card information for reloading purposes, reducing the risk of fraud.

Pros and Cons

Pros:

- Comprehensive financial education tools

- Customizable allowances and chore charts

- FDIC insured prepaid debit cards

- Available on multiple platforms (iOS, Android, Web)

- No credit check required

Cons:

- Monthly subscription fee

- Additional fees for card replacements or expedited shipping

- Limited investment options

Conclusion

FamZoo offers a robust platform for families looking to teach their children about money management. With its combination of prepaid debit cards and financial education tools, it provides a comprehensive solution for instilling good financial habits from a young age. While there are other options available, FamZoo’s focus on education and customization sets it apart in the family finance space